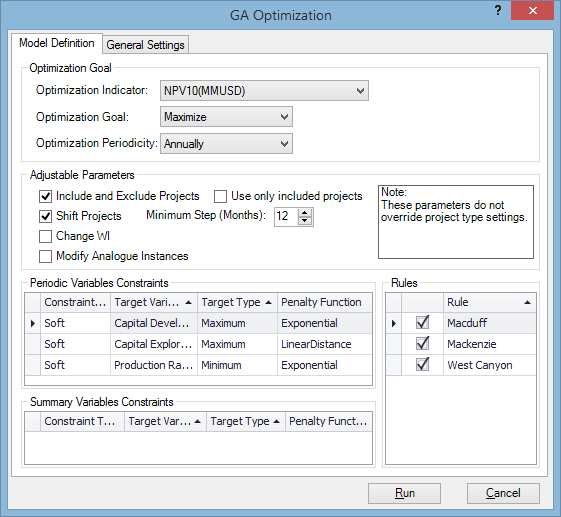

The Model Definition tab

This tab is used to define parameters for portfolio optimization. All sections are described in the table below.

| Field | Description |

|---|---|

| Optimization Indicator | This list contains all summary variables from configuration settings (see Summary Variables). This indicator is the basis for the optimization process. Only one indicator at a time can be used for optimization. |

| Optimization Goal | This list contains functions which will be used for optimization. All functions are described in the table below. If you select the Closest to, Minimal greater than or Maximal less than option, a text field will be displayed where you can specify a comparison value. |

| Optimization Periodicity | This field should be set to Annually wherever possible as this increases the speed and reduces memory consumption of the optimizer. |

| Adjustable Parameters |

The section tells the algorithm which actions can be performed to produce the desirable results; all options are described in the table below. Note that the more parameters you use, the bigger the search space will be which will make optimization more likely to fail unless these parameters are selected very carefully. Also make sure that the selected parameters are realistic: for example, select the Change WI option only if projects can have an equity change. Note: These options take into account project type settings. For example, if a project belongs to a non-divestible type, it will not be excluded even if the Include and Exclude Projects box is checked. |

| Periodic Variables Constraints |

This table determines which periodic variable targets will be considered during optimization. The targets are set up in the configuration settings (see Periodic Variables) and their values are entered on the Set Targets tab (see Targets). The Target Type column is populated automatically and cannot be edited. To include a target into optimization, select the Hard or Soft option in the Constraint Type column. If a generated portfolio does not meet a hard target, then it will be discarded. However, if it does not meet a soft target, a penalty function will be applied. Penalty functions and their variations are described in the table below. For more information, see Soft constraints penalty and Application of penalties. We recommend gradually applying the constraints and gradually tightening them up. For example, start with a single soft constraint on production, see how well this target is met, identify a viable target and then switch it to a hard constraint or add additional constraints such as capex. Also note that the GA does not have to start with a random portfolio; it can start where the last run left off which will enable it to work from a previous maximum and search beyond that. |

| Summary Variables Constraints | This table determines which summary variable targets will be considered during optimization. The targets are set up in the configuration settings (see Summary Variables) and their values are entered on the Set Targets tab (see Targets). Constraint types and the penalty function are the same as in the Target Constraints table. |

| Rules | In this table, select business rules which the optimized portfolio must satisfy. For information about rules, see Business rules. |

The following table describes available optimization functions.

| Function | Description |

|---|---|

| Minimize | The algorithm will search for the smallest value of the optimization indicator. |

| Maximize | The algorithm will search for the largest value of the optimization indicator. |

| Closest to | The algorithm will search for the value closest to the number in the text field. The closest value can be greater or less than the specified number. |

| Minimal greater than | The algorithm will search for the minimal value of the optimization indicator which is greater than the number in the text field. |

| Maximal less than | The algorithm will search for the maximal value of the optimization indicator which is less than the number in the text field. |

The following table describes available adjustable parameters.

| Option | Description |

|---|---|

| Include and Exclude Projects |

This box is always checked as at least one kind of change to project settings is needed for optimization. Note: If an MEG is included in optimization and the Include and Exclude Projects box is unchecked, only the previously included project from that MEG will be considered for optimization. If this box is checked, a different project from that MEG may be included. For more information, see Mutually Exclusive Groups. |

| Use Only Included Projects | Check this box to optimize only currently included projects. This option is useful if you have already excluded projects on some basis that is not relevant to the optimizer. |

| Shift Projects | If you check this box, the Minimum Step (months) field will become active where you can specify the minimal number of months by which projects can be shifted. |

| Change WI | If you check this box, the Minimum Step (%) field will become active. Here you can specify the increment by which your working interest share can be changed. |

| Modify Analogue Instances | If you check this box, the number of instances in projects with analogues will be modified. |

The following table describes available penalty functions. For more information, see Soft constraints penalty and Application of penalties.

| Function | Description |

|---|---|

| Linear Distance | Deviation from the target, calculated as (Portfolio Value – Target Value) / Target Value. Any deviation from the target is heavily penalized. If deviations occur in more than one period, they are added. This function discards unsuitable solutions rapidly, but may fail to differentiate between various acceptable solutions if only a few combinations are possible and deviations are large. The Linear Distance functions have the following variations: Time Weighted at 5% (TW05), Time Weighted at 25% (TW25), and Soft Threshold at 30% (ST30%). |

| Exponential | Exponential deviation from target, calculated on the basis of linear deviation as 1 – EXP (1 / Linear Distance). The function reduces the penalty and puts it in a scale from 0 to 100. The total penalty is calculated as the average of all periods instead of the sum. This function is used when a small number of combinations satisfy the specified target, or to reduce the impact of big outliers in single periods. The Exponential functions have the following variations: Time Weighted at 5% (TW05), Time Weighted at 25% (TW25), Soft Threshold at 30% (ST30%), and Hard Threshold (HT). |

| Time Weighted (TW) | The penalty is reduced for later periods. It is discounted in each period according to its weight (5% or 25%). Use this function to give less weight to deviations from the target which occur in later periods. |

| Soft Threshold (ST) | The threshold sets a cap on the maximum penalty for a given period. If the penalty exceeds 30%, it will be set to 30% for that period. This reduces the impact of large outliers in a given period on the total penalty. |

| Hard Threshold (HT) | The threshold sets a cap on the maximum penalty for a given period. If the penalty exceeds 100%, it will be set to 100% for that period. This reduces the impact of large outliers in a given period on the total penalty. |